-

What is a General Power of Attorney in Massachusetts?

A General Power of Attorney (POA) is a legal document that allows you to appoint someone else, known as your agent, to make decisions on your behalf. This can include financial matters, legal issues, and other personal affairs. The authority granted can be broad or limited, depending on your needs.

-

Who can be my agent?

Your agent can be anyone you trust, such as a family member, friend, or professional advisor. However, they must be at least 18 years old and mentally competent. It’s important to choose someone who will act in your best interest.

-

What powers can I grant to my agent?

You can grant a wide range of powers, including but not limited to:

- Managing your bank accounts

- Handling real estate transactions

- Paying bills

- Filing taxes

- Making legal decisions

It’s essential to specify the powers you wish to grant to avoid any confusion later.

-

How do I create a General Power of Attorney in Massachusetts?

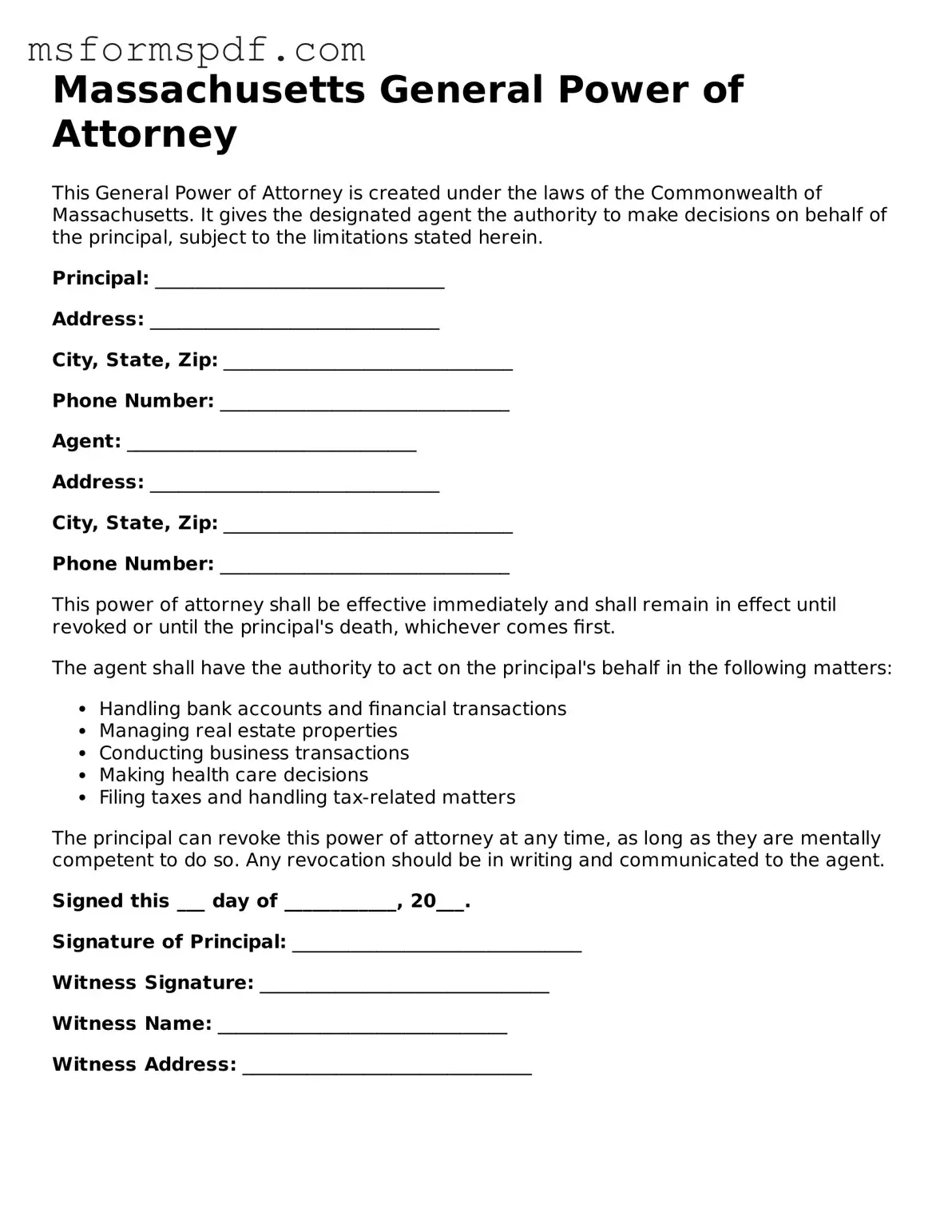

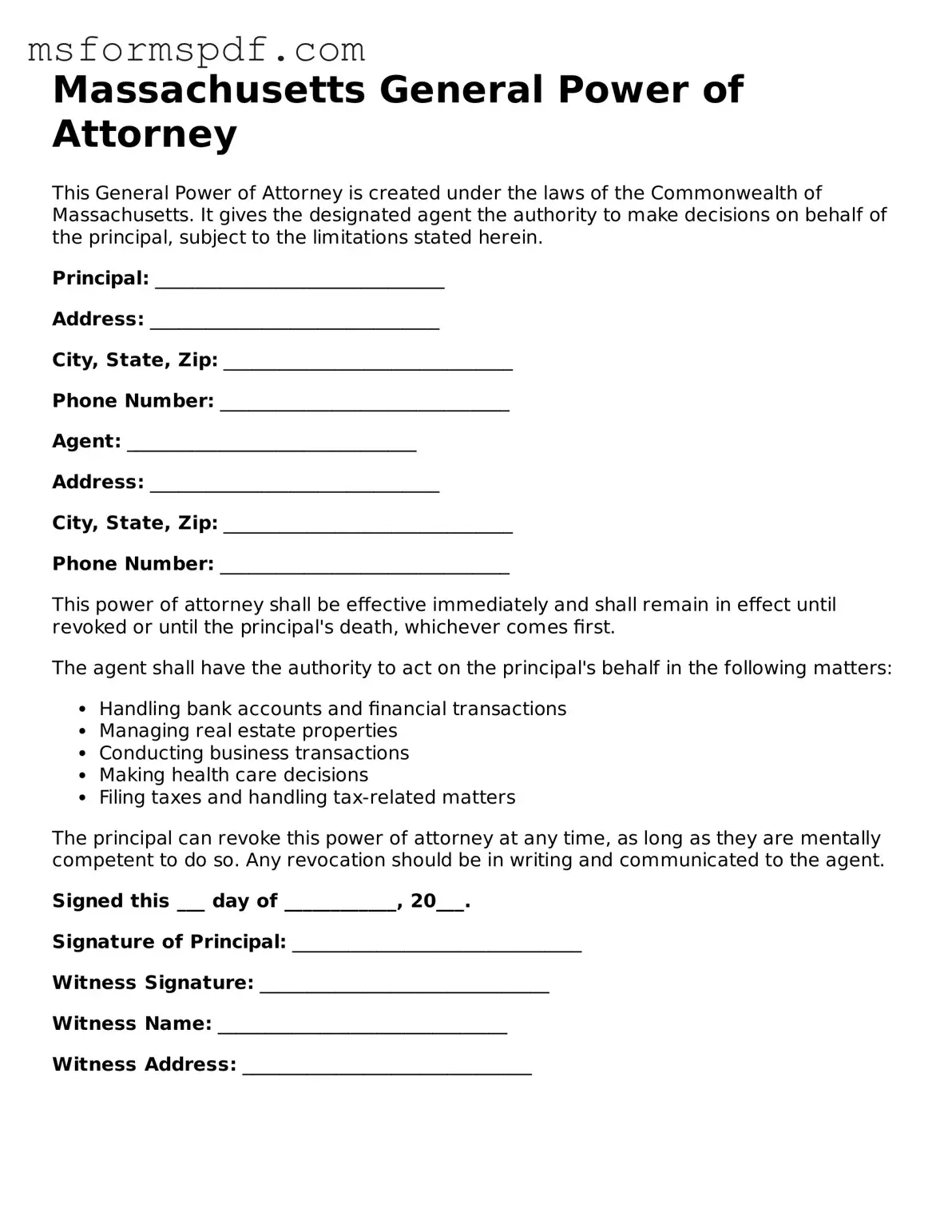

To create a General POA, you need to fill out the appropriate form, which can often be found online or through legal offices. After completing the form, you must sign it in front of a notary public. This step is crucial, as it adds an extra layer of authenticity to the document.

-

Do I need to have my General Power of Attorney notarized?

Yes, in Massachusetts, your General Power of Attorney must be notarized to be valid. This ensures that the document is recognized legally and can be enforced when needed.

-

Can I revoke a General Power of Attorney?

Yes, you can revoke a General POA at any time as long as you are mentally competent. To do this, you should create a written revocation document and notify your agent and any institutions that have your POA on file.

-

What happens if I become incapacitated?

If you become incapacitated and have a General POA in place, your agent can step in and make decisions on your behalf. This is one of the primary reasons people create a POA, ensuring that someone they trust can manage their affairs when they cannot.

-

Is a General Power of Attorney the same as a Durable Power of Attorney?

No, they are not the same. A General POA typically becomes invalid if you become incapacitated, while a Durable Power of Attorney remains effective even in such situations. If you want your agent to act on your behalf during incapacity, you should specify that it is durable.

-

Can I limit the powers of my agent?

Yes, you can limit the powers granted to your agent in the General POA. Clearly outline the specific powers you wish to grant and any limitations you want to impose. This helps prevent misuse of authority.

-

Where should I keep my General Power of Attorney document?

Store your General POA in a safe but accessible place. Inform your agent and trusted family members where it is located. You may also want to provide copies to your agent and any institutions that may need it, such as banks or healthcare providers.