Free Massachusetts 127 Template in PDF

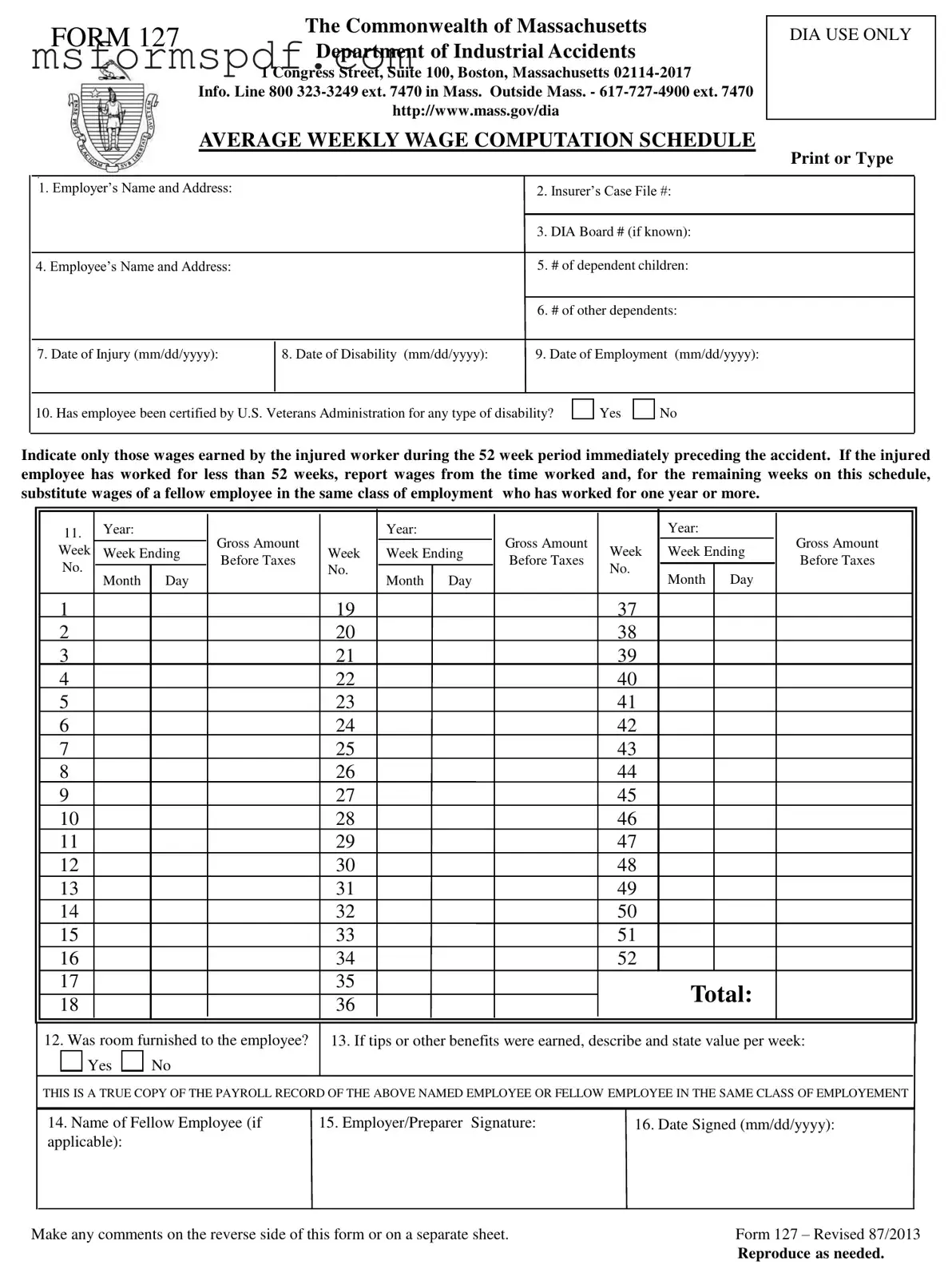

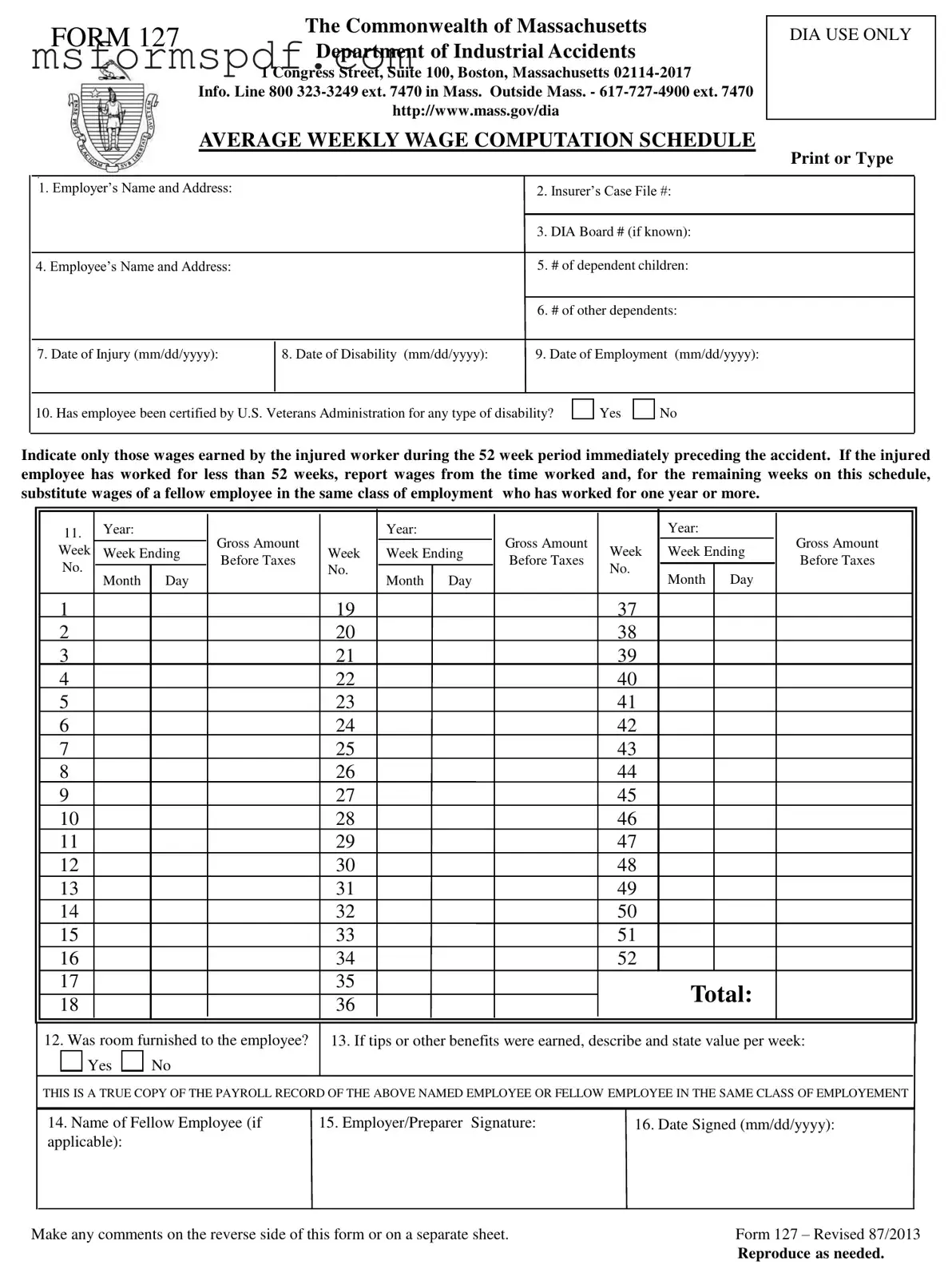

The Massachusetts 127 form is a document used by the Commonwealth of Massachusetts to compute an employee's average weekly wage in the context of workers' compensation claims. It is essential for employers and insurers to accurately report wages earned by an injured worker during the 52 weeks preceding an accident. This form facilitates the determination of benefits owed to employees who have sustained injuries on the job.

Launch Editor Now

Free Massachusetts 127 Template in PDF

Launch Editor Now

Launch Editor Now

or

➤ Massachusetts 127 PDF Form

Just a moment — finish the form

Fill out Massachusetts 127 digitally — no scanning, no printing.