Free Massachusetts 2G Template in PDF

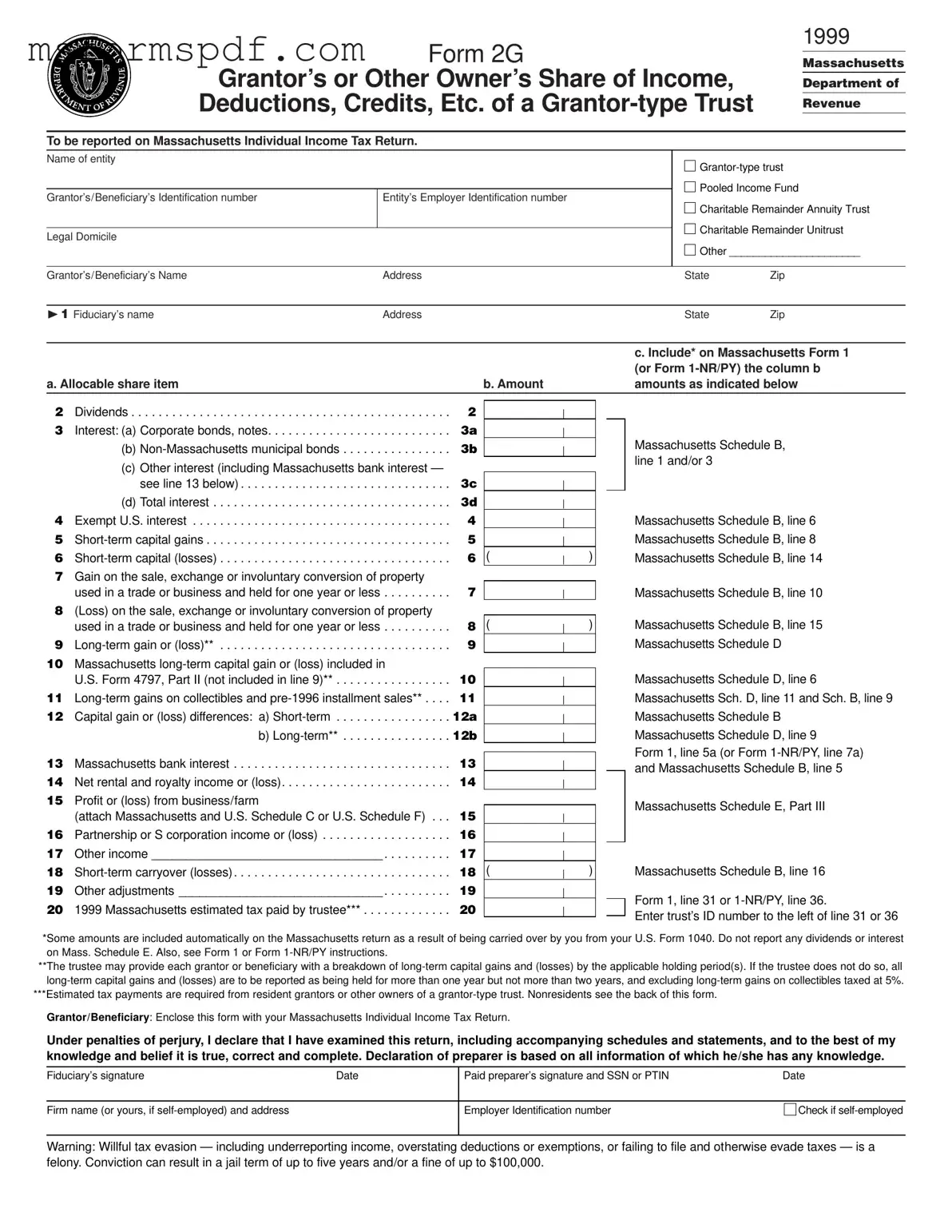

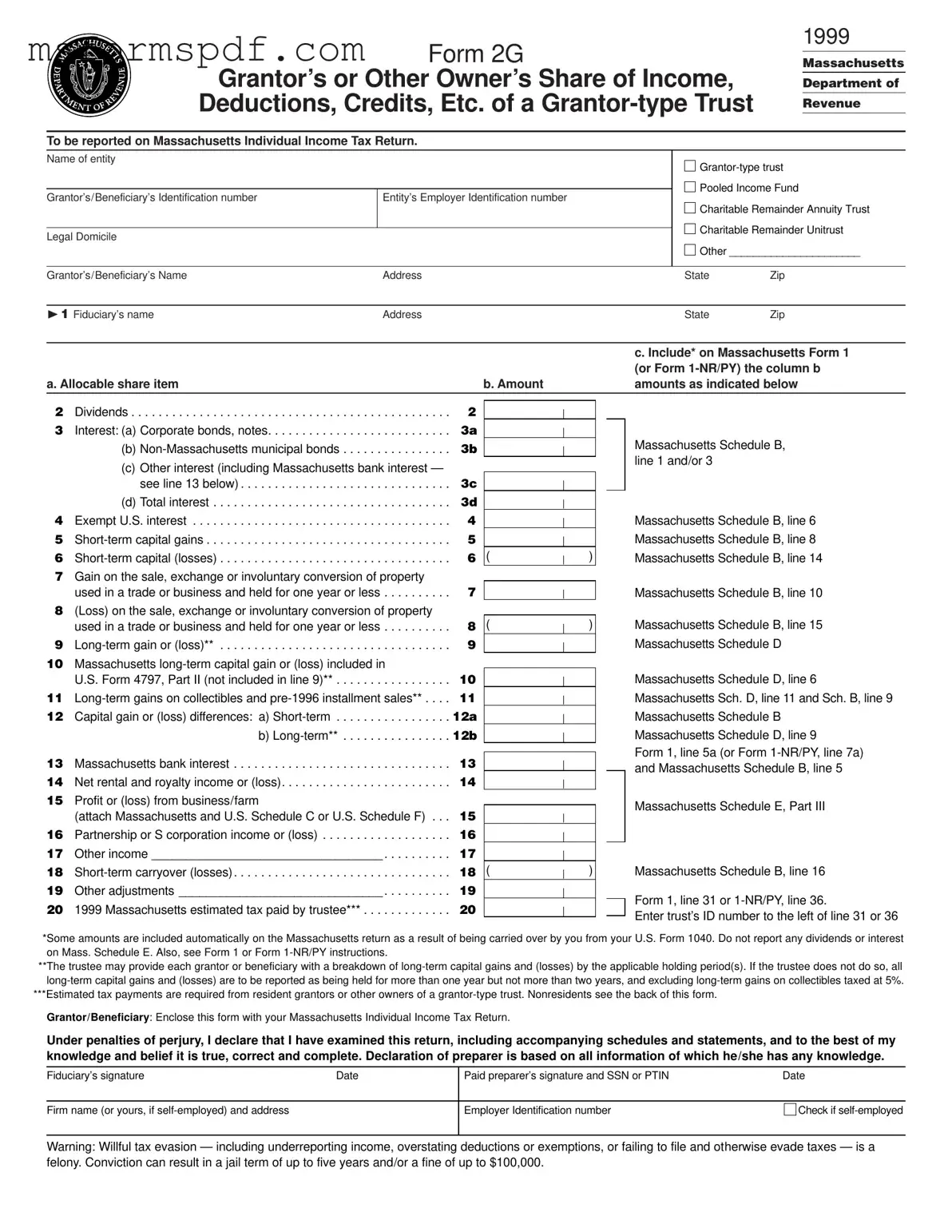

The Massachusetts 2G form, officially known as the Grantor’s or Other Owner’s Share of Income, Deductions, Credits, Etc. of a Grantor-type Trust, is a crucial document for reporting income related to grantor-type trusts. This form must be included with the Massachusetts Individual Income Tax Return and is essential for both grantors and beneficiaries to accurately report their financial activities. Understanding its requirements can simplify the tax filing process and ensure compliance with state regulations.

Launch Editor Now

Free Massachusetts 2G Template in PDF

Launch Editor Now

Launch Editor Now

or

➤ Massachusetts 2G PDF Form

Just a moment — finish the form

Fill out Massachusetts 2G digitally — no scanning, no printing.