Free Massachusetts 355U Template in PDF

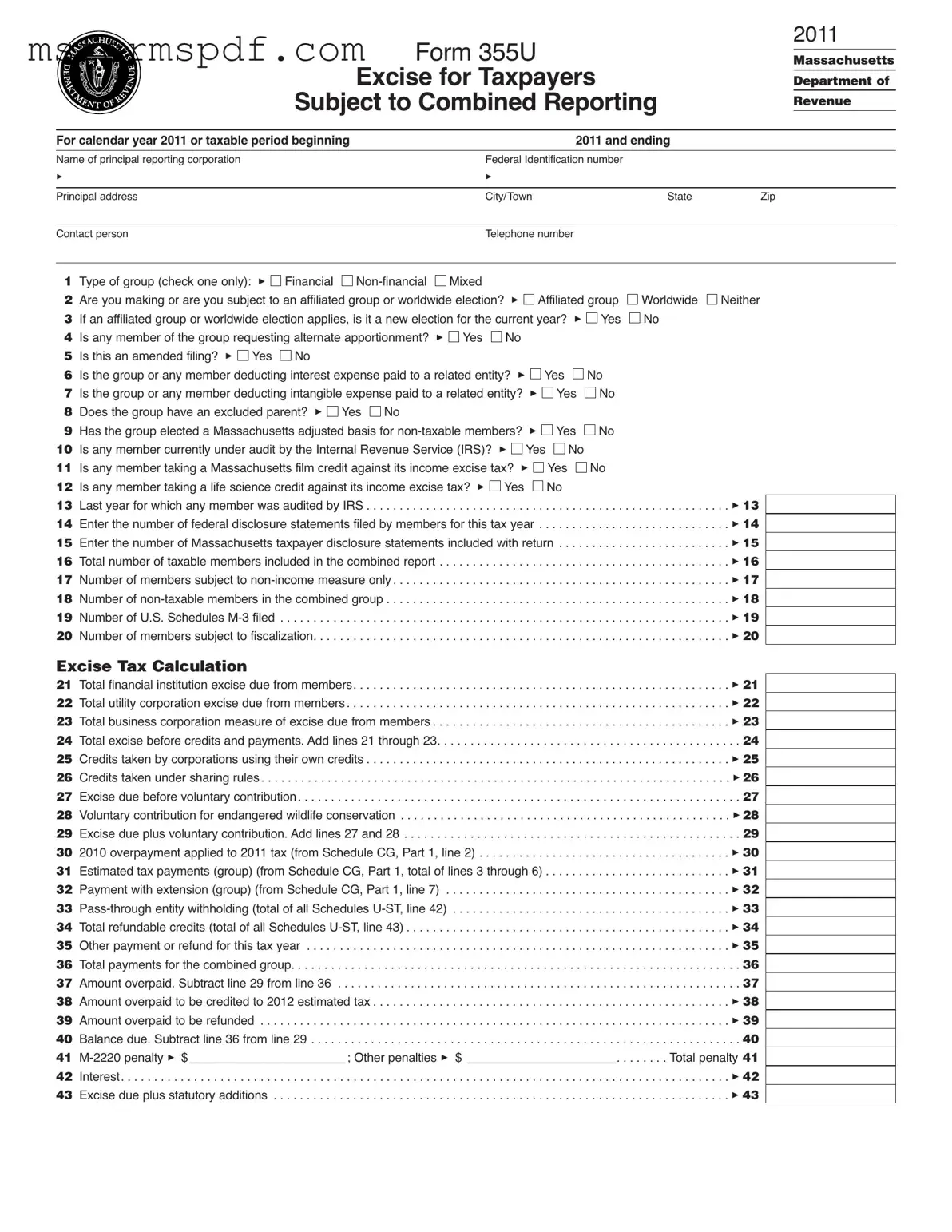

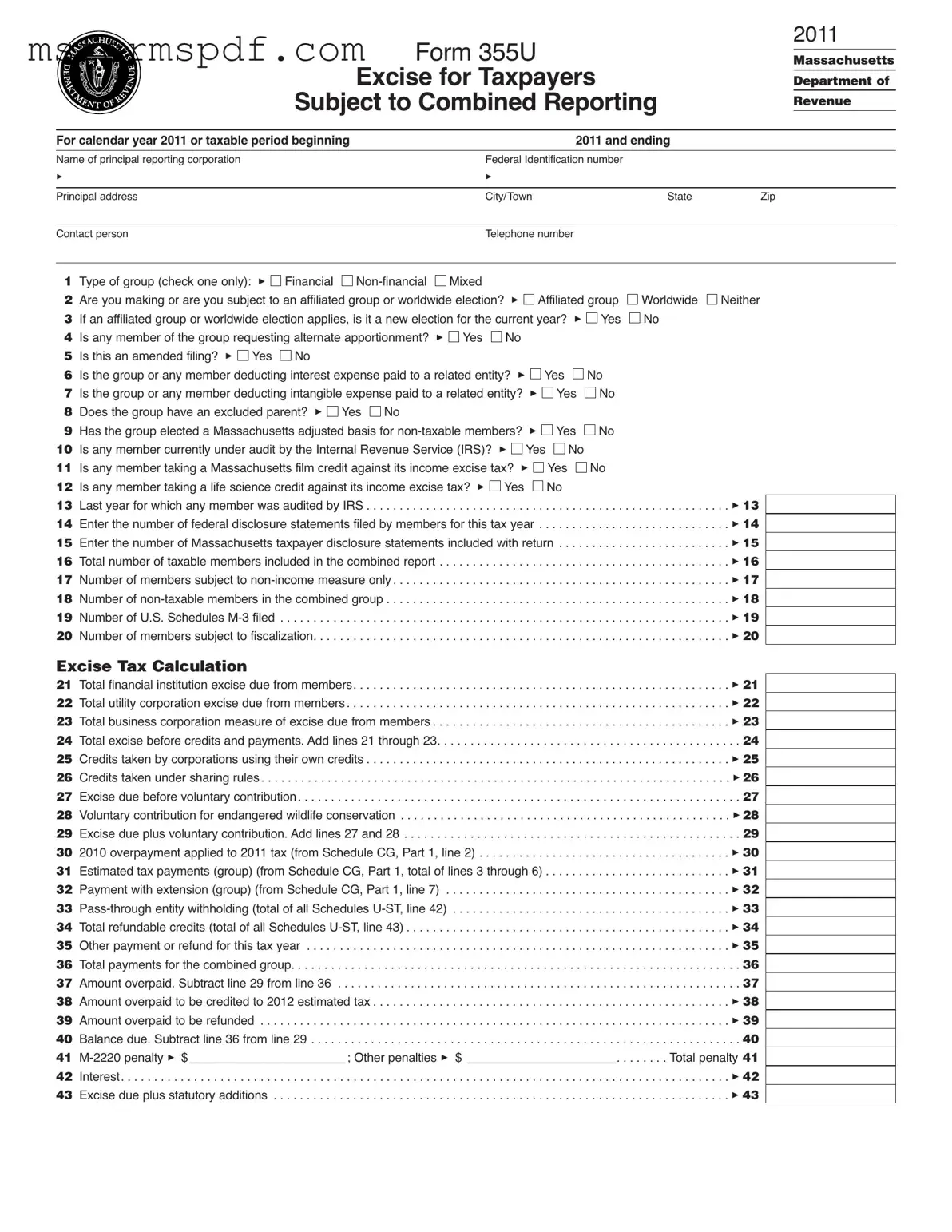

The Massachusetts 355U form is a tax document specifically designed for taxpayers subject to combined reporting. This form is essential for corporations that operate as part of a combined group, allowing them to report their income and calculate their excise tax obligations accurately. Understanding how to complete this form is crucial for compliance with Massachusetts tax regulations.

Launch Editor Now

Free Massachusetts 355U Template in PDF

Launch Editor Now

Launch Editor Now

or

➤ Massachusetts 355U PDF Form

Just a moment — finish the form

Fill out Massachusetts 355U digitally — no scanning, no printing.