Free Massachusetts 3M Template in PDF

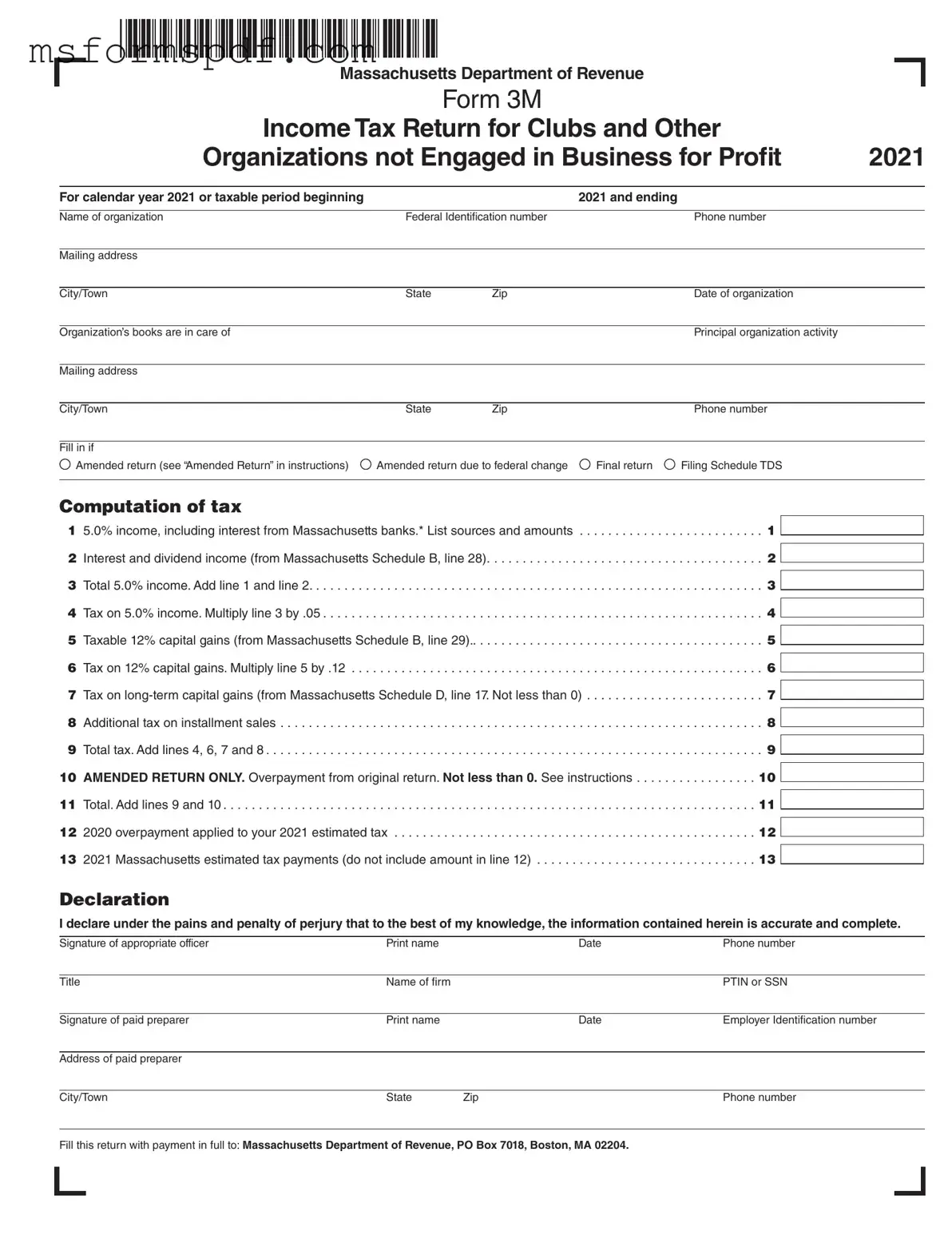

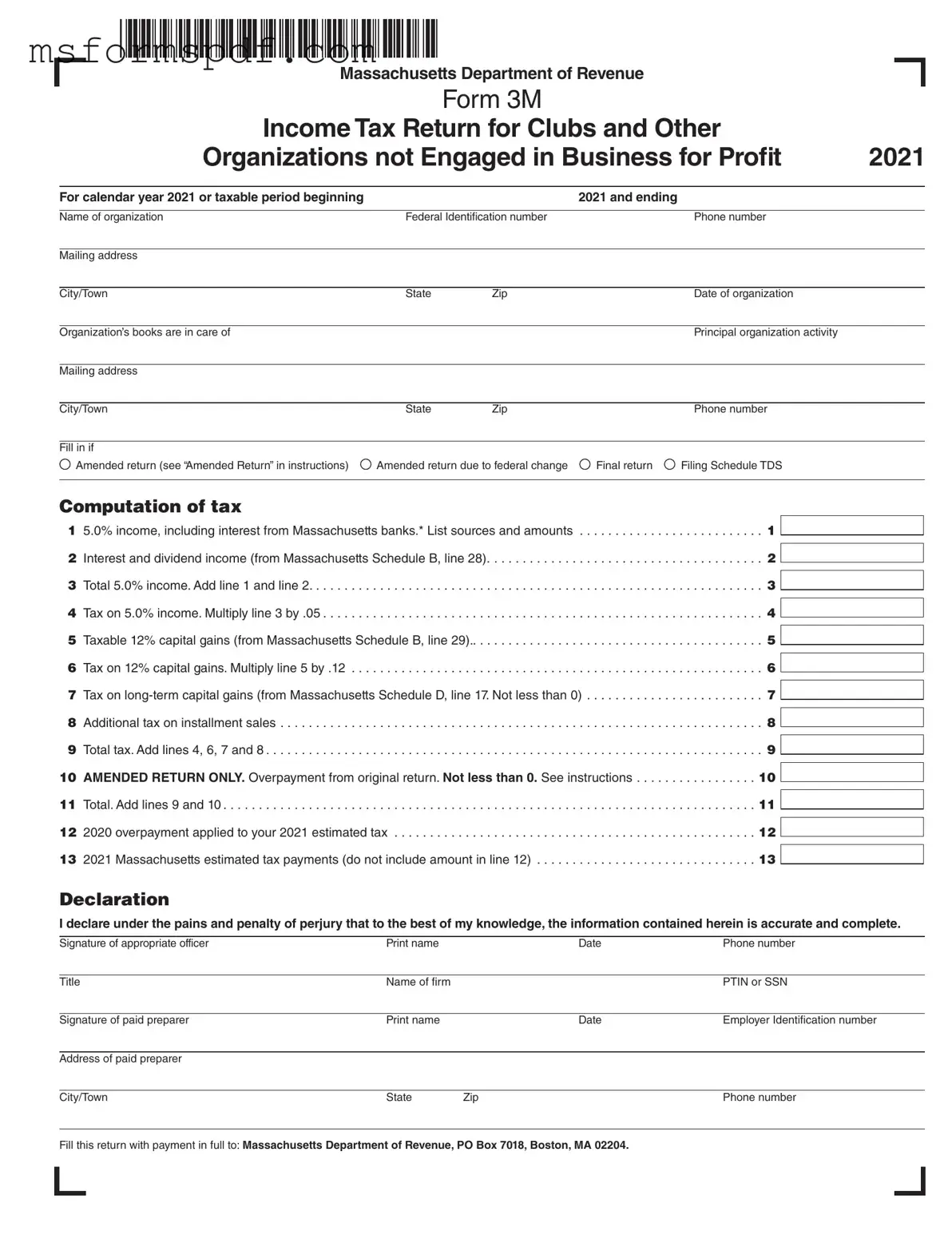

The Massachusetts 3M form is an income tax return specifically designed for clubs and other organizations that do not engage in business for profit. This form allows these entities to report their taxable income, including interest, dividends, and capital gains. Proper completion of the 3M form ensures compliance with state tax regulations while facilitating the accurate assessment of any taxes owed or refunds due.

Launch Editor Now

Free Massachusetts 3M Template in PDF

Launch Editor Now

Launch Editor Now

or

➤ Massachusetts 3M PDF Form

Just a moment — finish the form

Fill out Massachusetts 3M digitally — no scanning, no printing.