-

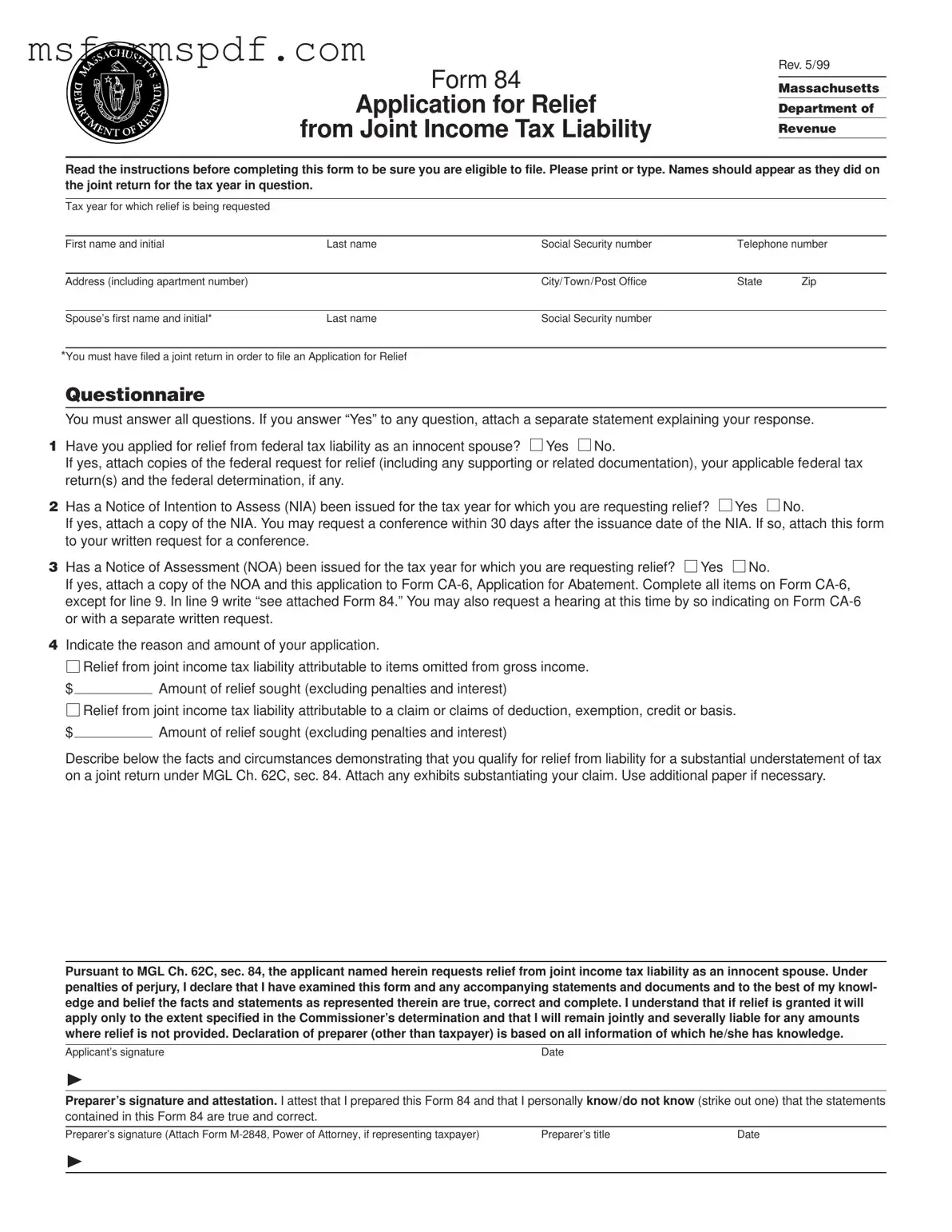

What is the Massachusetts Form 84?

The Massachusetts Form 84, also known as the Application for Relief from Joint Income Tax Liability, allows individuals to request relief from joint tax liability under specific conditions. This form is used when a taxpayer believes they should not be held responsible for a tax deficiency due to their spouse's actions.

-

Who is eligible to file Form 84?

To be eligible to file Form 84, you must have filed a joint tax return with your spouse for the tax year in question. Additionally, you must demonstrate that you did not know, and had no reason to know, about any substantial understatement of tax. You should also show that it would be inequitable to hold you liable for the deficiency.

-

What are the requirements for applying for relief?

You must complete all sections of the form and provide supporting documentation. This includes any federal requests for relief, Notices of Intention to Assess (NIA), or Notices of Assessment (NOA) that pertain to the tax year in question. You must also explain the facts and circumstances that support your claim for relief.

-

What constitutes a substantial understatement of tax?

A substantial understatement occurs when the understated tax exceeds $200 due to omitted gross income or exceeds $500 due to erroneous claims of deductions, exemptions, credits, or basis. These thresholds must be met for your application to be considered.

-

What happens if I receive a Notice of Intention to Assess (NIA)?

If you receive an NIA, you must submit Form 84 within 30 days of the issuance date. You are entitled to request a conference within this period. Attach your completed Form 84 to your written request for the conference.

-

What if I have already received a Notice of Assessment (NOA)?

If you have received an NOA, you need to file an Application for Abatement (Form CA-6) and attach Form 84 to it. In Form CA-6, indicate “see attached Form 84” in Item 9. You may also request a hearing at this time.

-

How do I submit Form 84?

Mail your completed Form 84 along with any attachments, such as the NIA or NOA, to the address specified on the NIA or the Massachusetts Department of Revenue, Customer Service Bureau, PO Box 7031, Boston, MA 02204.

-

Will filing Form 84 stop tax collection efforts?

No, the filing of Form 84 does not automatically stay the collection of tax. Collection efforts will continue until your application is approved. If approved, any resulting overpayment will be refunded.

-

What will happen after I submit Form 84?

You will receive a written notice of determination from the Massachusetts Department of Revenue. This notice will specify the extent of any relief granted. You will remain jointly and severally liable for any amounts not covered by the relief.

-

What if I provided false information on Form 84?

If relief was obtained through false or fraudulent means, the relief granted will be void. It is essential to provide accurate and truthful information when completing the form.