Free Massachusetts Claim Template in PDF

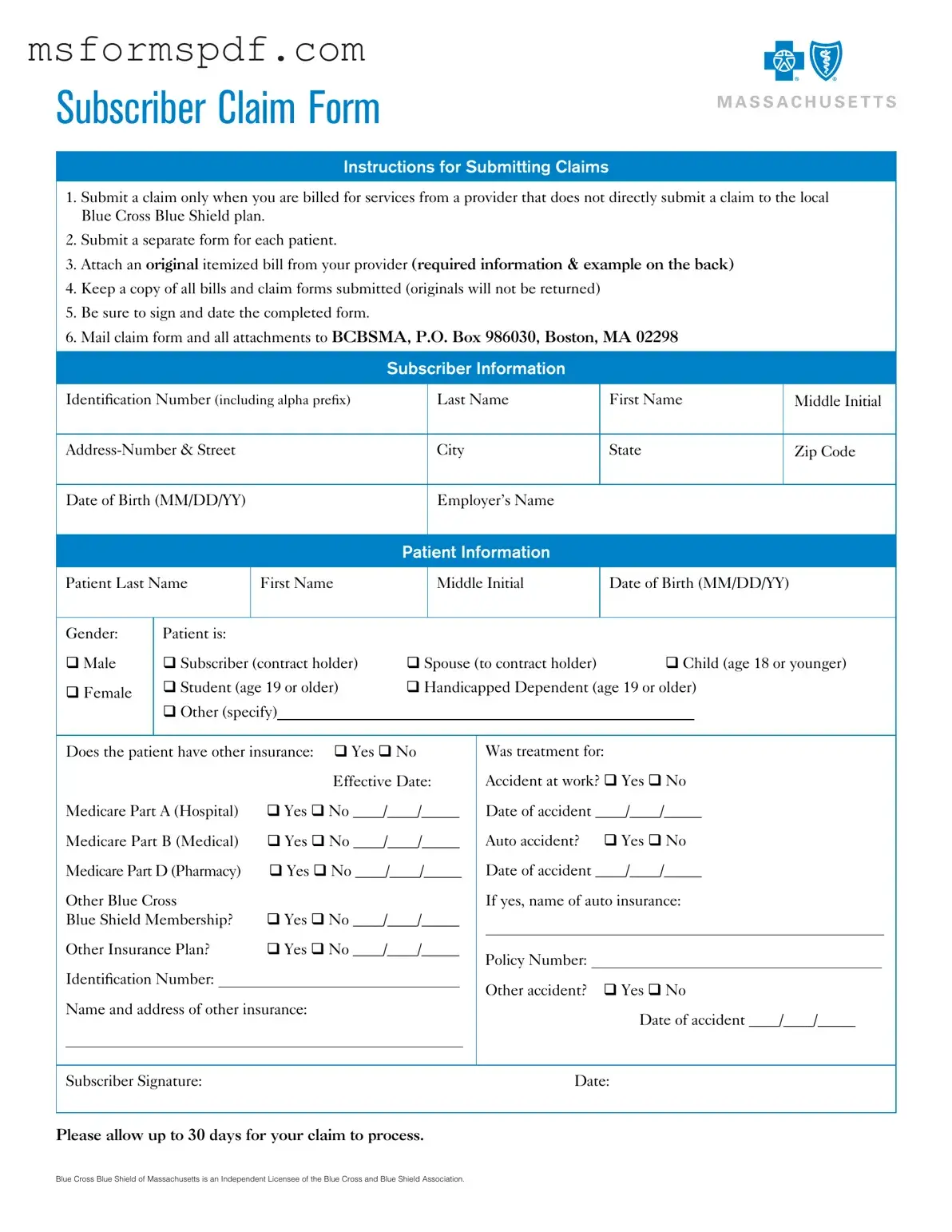

The Massachusetts Claim Form is a document used by subscribers to request reimbursement for medical services when their healthcare provider does not submit a claim directly to the local Blue Cross Blue Shield plan. This form is essential for ensuring that you receive the benefits you are entitled to under your health insurance plan. Proper completion and submission of this form can help facilitate the claims process and ensure timely reimbursement.

Launch Editor Now

Free Massachusetts Claim Template in PDF

Launch Editor Now

Launch Editor Now

or

➤ Massachusetts Claim PDF Form

Just a moment — finish the form

Fill out Massachusetts Claim digitally — no scanning, no printing.