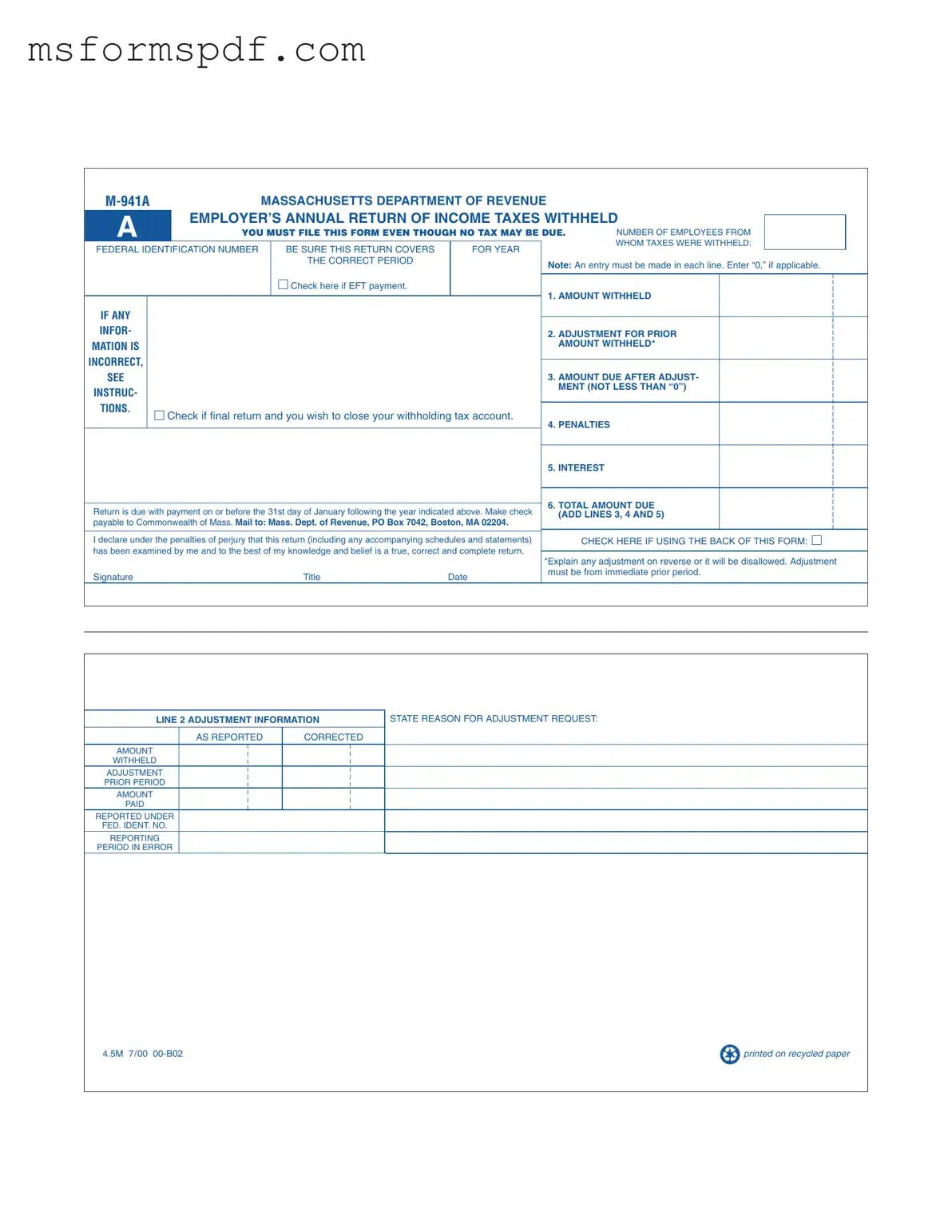

Free Massachusetts M 941A Template in PDF

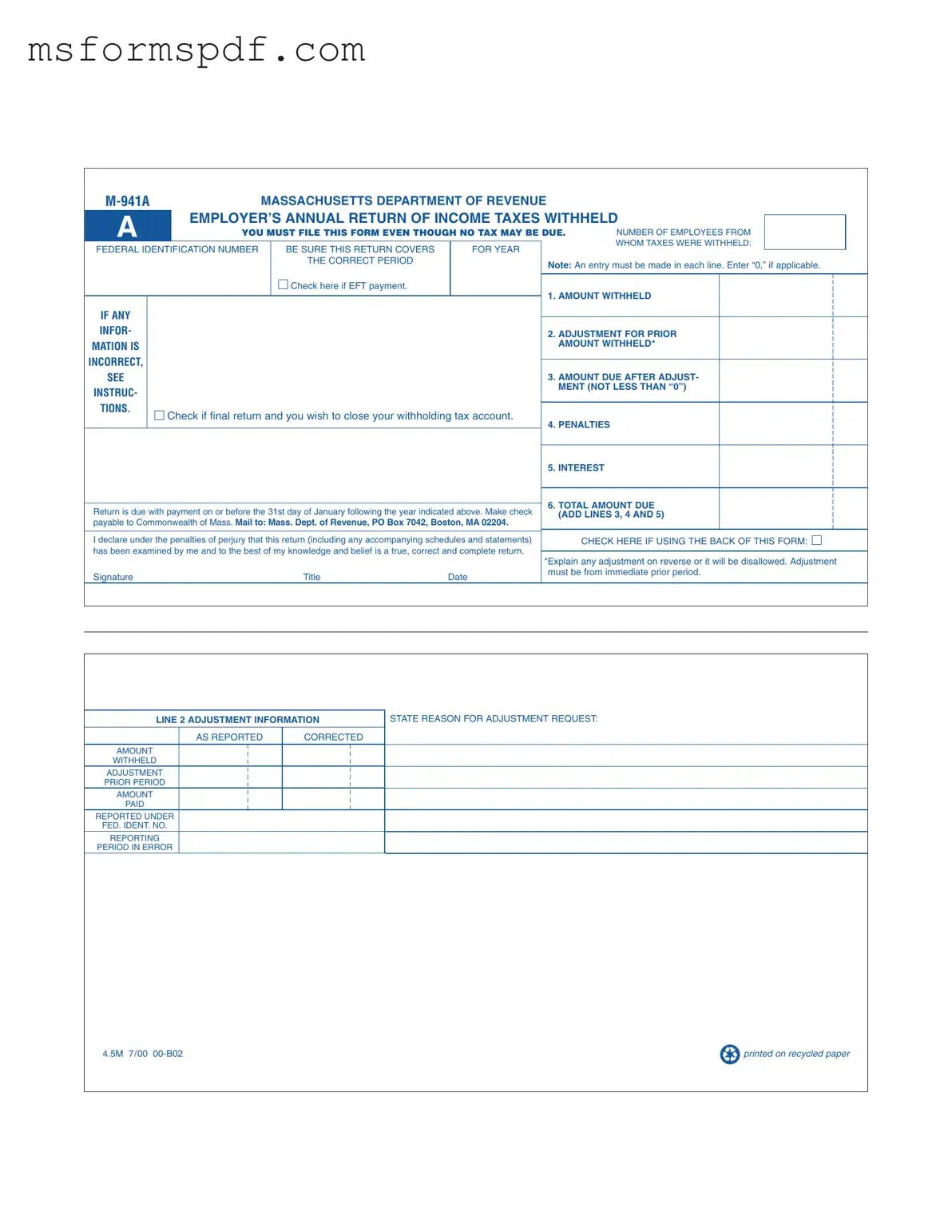

The Massachusetts M 941A form is an essential document for employers, serving as the annual return for income taxes withheld from employees. Even if no tax is due, filing this form is mandatory. It ensures compliance with state regulations and provides a clear record of withheld taxes for the specified year.

Launch Editor Now

Free Massachusetts M 941A Template in PDF

Launch Editor Now

Launch Editor Now

or

➤ Massachusetts M 941A PDF Form

Just a moment — finish the form

Fill out Massachusetts M 941A digitally — no scanning, no printing.