Free Massachusetts Short Financial Statement Template in PDF

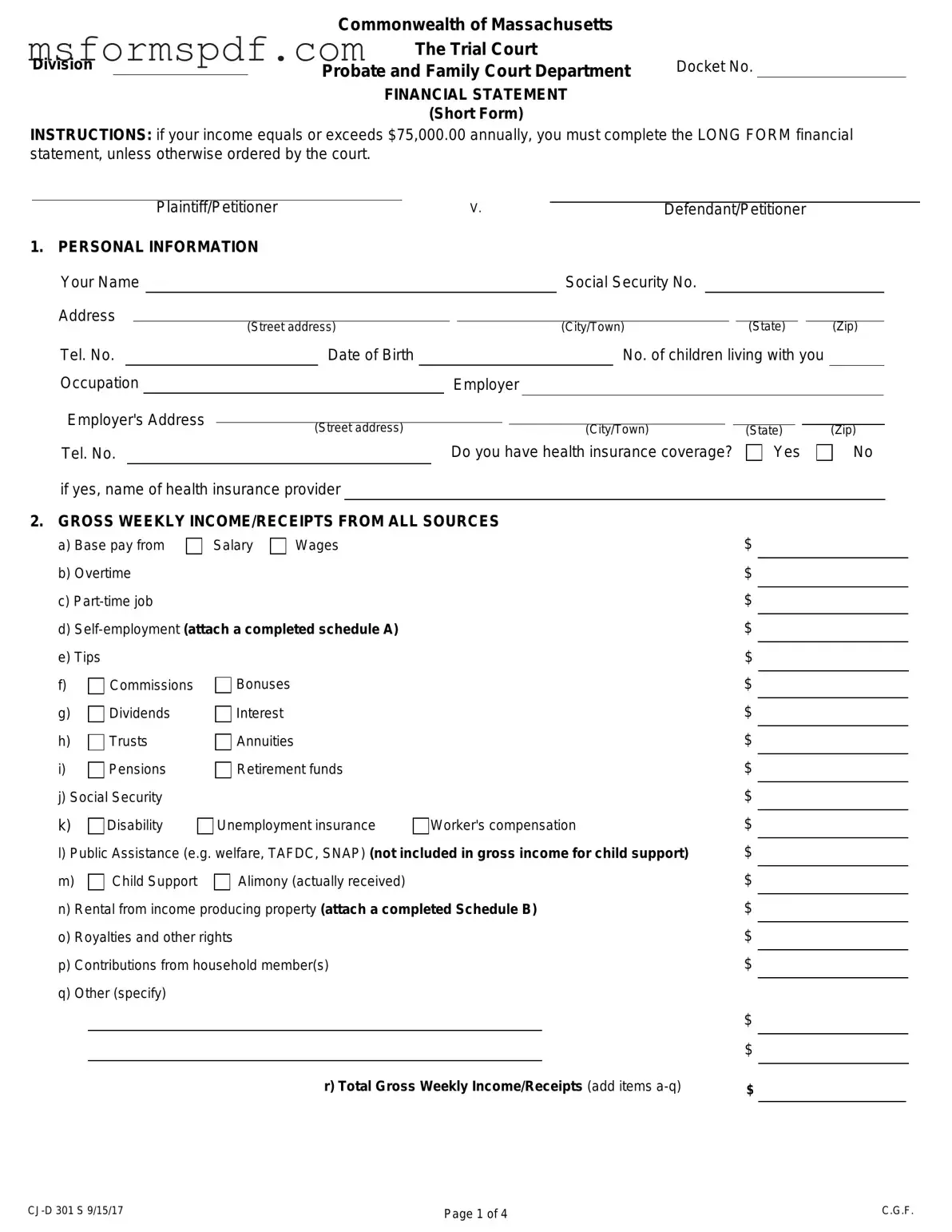

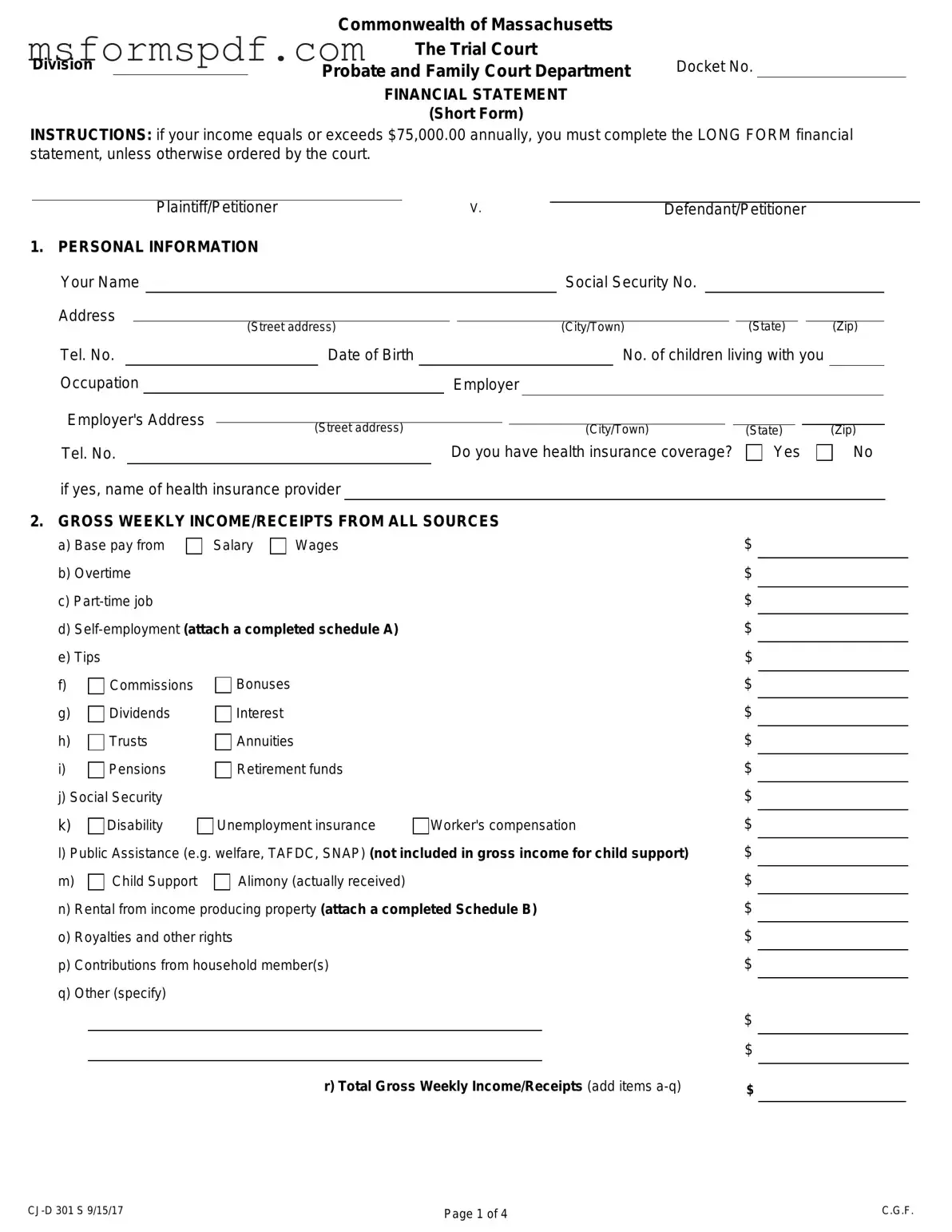

The Massachusetts Short Financial Statement form is a simplified document used in the Probate and Family Court to disclose an individual's financial situation. This form is required for those whose annual income is below $75,000, allowing for a streamlined process in financial disclosures during legal proceedings. Completing this form accurately is essential for fair assessments in matters such as child support and alimony.

Launch Editor Now

Free Massachusetts Short Financial Statement Template in PDF

Launch Editor Now

Launch Editor Now

or

➤ Massachusetts Short Financial Statement PDF Form

Just a moment — finish the form

Fill out Massachusetts Short Financial Statement digitally — no scanning, no printing.