Free Massachusetts St 13 Template in PDF

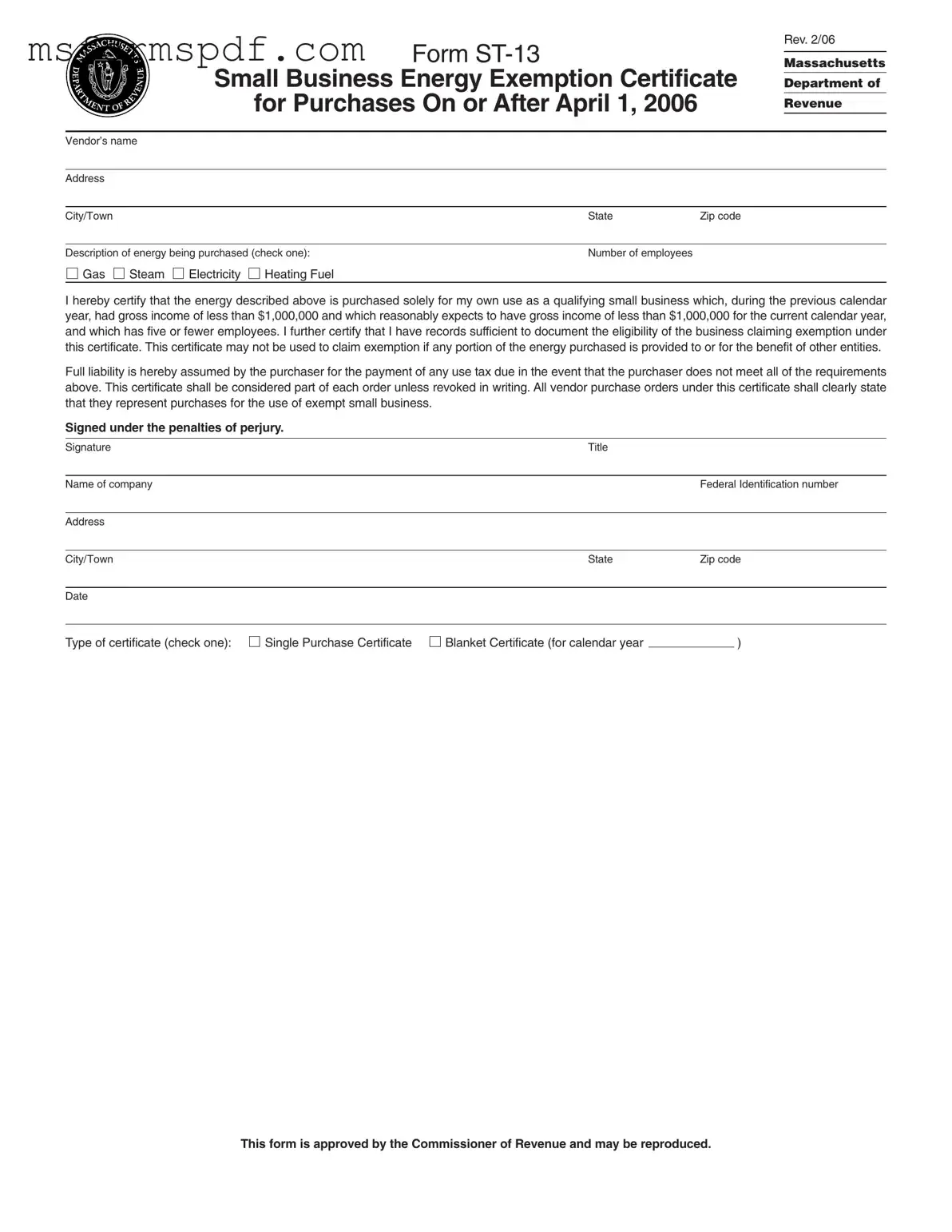

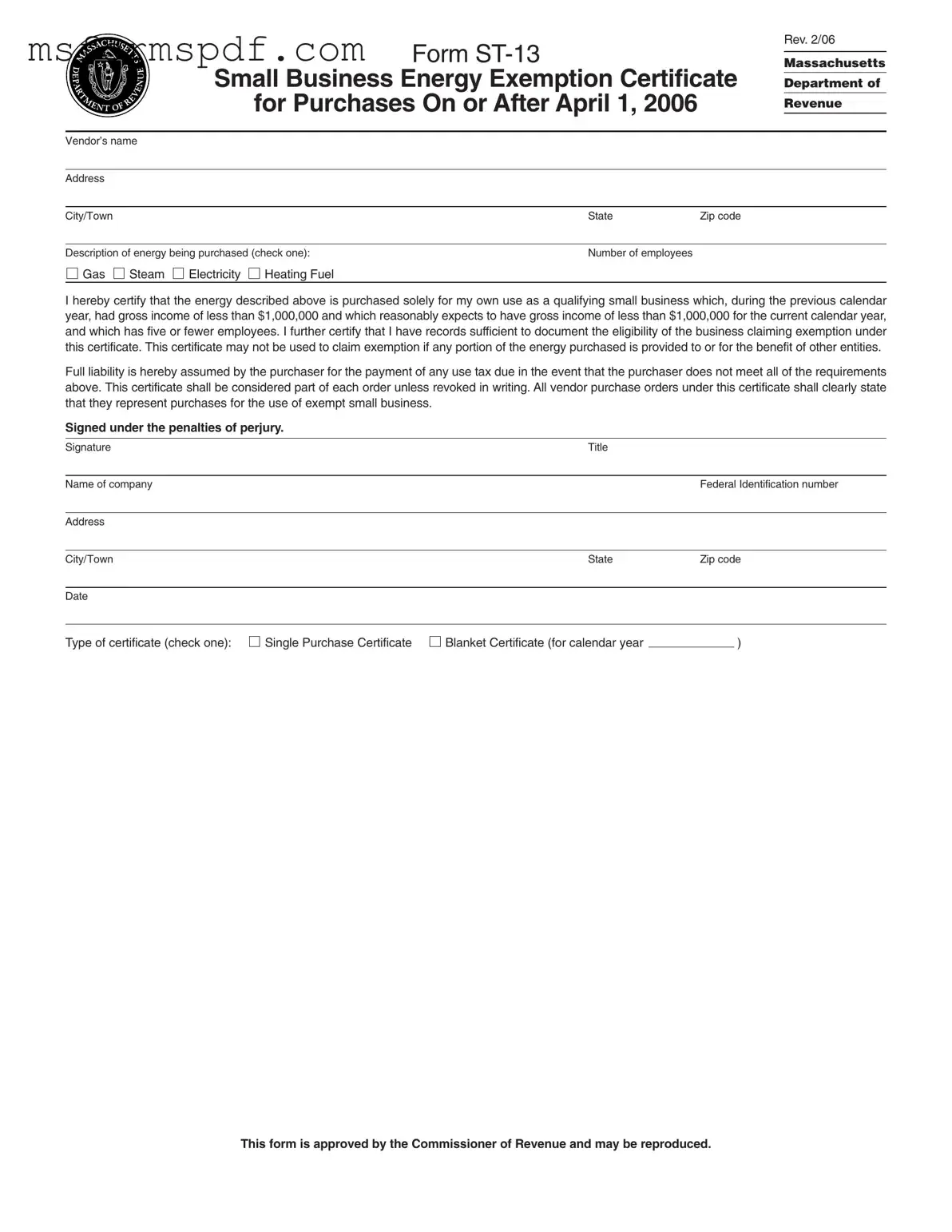

The Massachusetts ST-13 form serves as the Small Business Energy Exemption Certificate, allowing qualifying small businesses to purchase certain energy types without paying sales tax. To be eligible, a business must have had gross income of less than $1,000,000 in the previous year and reasonably expect to maintain that threshold in the current year, while employing five or fewer individuals. This form is essential for small businesses looking to manage their operational costs effectively while complying with state regulations.

Launch Editor Now

Free Massachusetts St 13 Template in PDF

Launch Editor Now

Launch Editor Now

or

➤ Massachusetts St 13 PDF Form

Just a moment — finish the form

Fill out Massachusetts St 13 digitally — no scanning, no printing.