Free Massachusetts St 6 Template in PDF

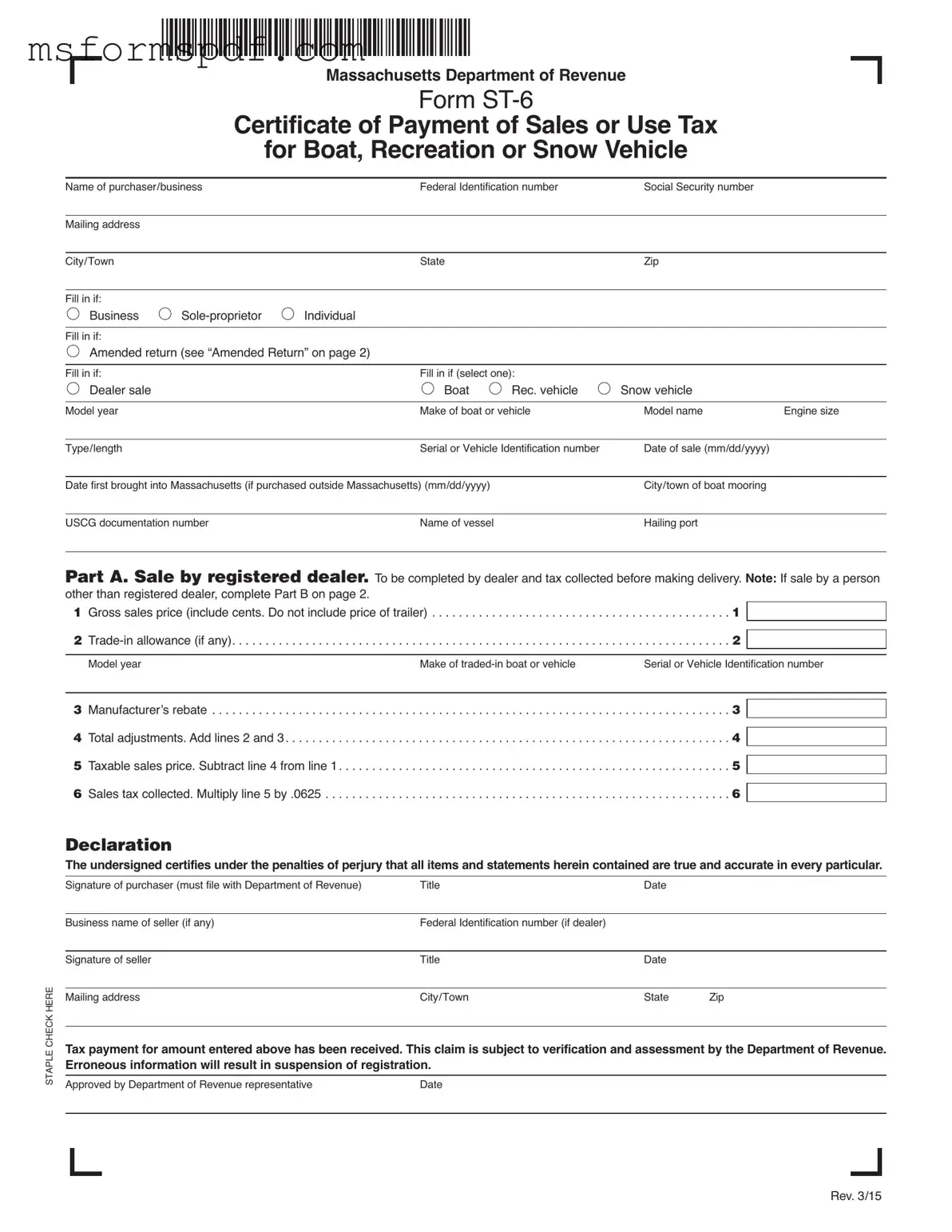

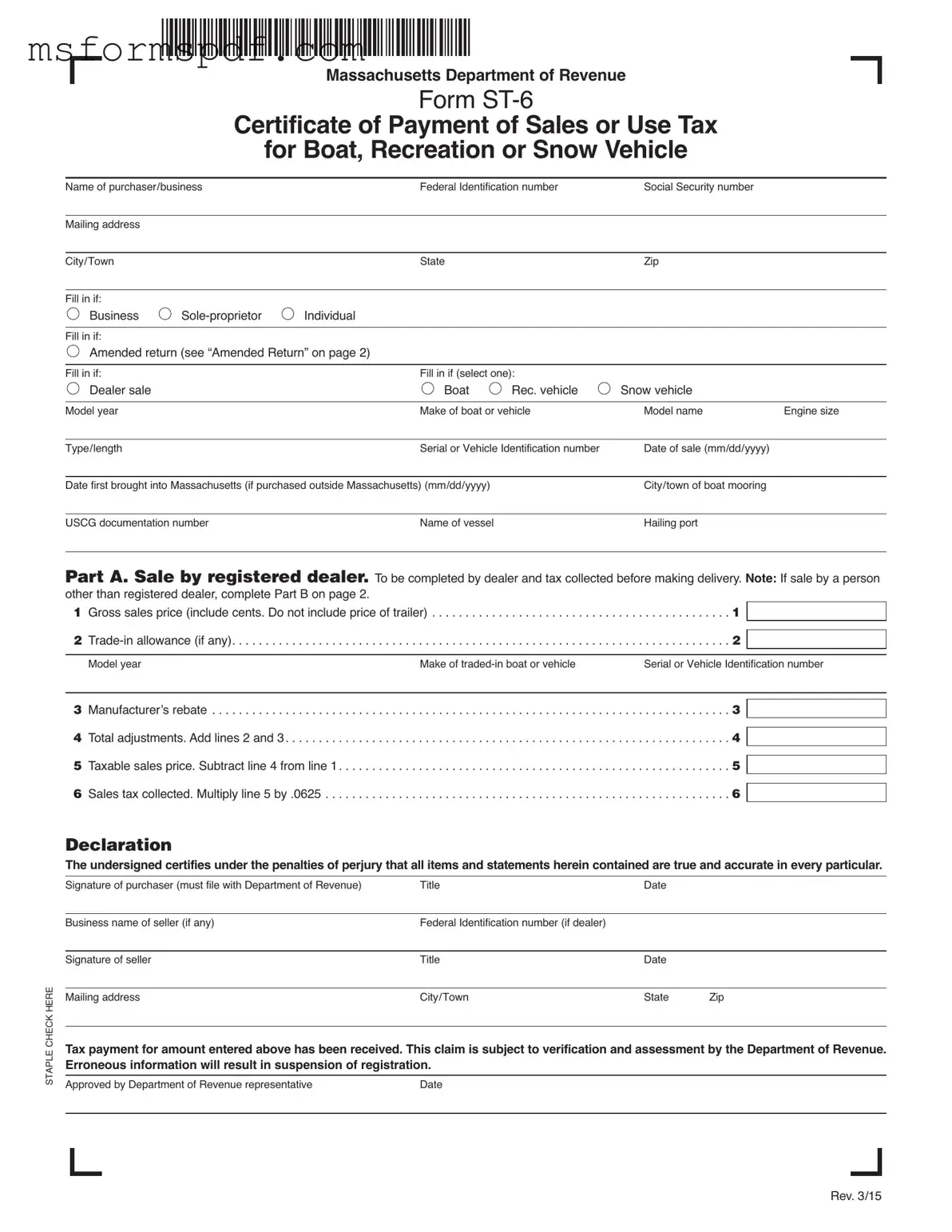

The Massachusetts St 6 form is a certificate used to confirm the payment of sales or use tax for boats, recreational vehicles, or snow vehicles. This document is essential for both registered dealers and individuals selling these items, ensuring compliance with state tax regulations. Accurate completion of the form is crucial, as any errors may lead to registration suspension or other penalties.

Launch Editor Now

Free Massachusetts St 6 Template in PDF

Launch Editor Now

Launch Editor Now

or

➤ Massachusetts St 6 PDF Form

Just a moment — finish the form

Fill out Massachusetts St 6 digitally — no scanning, no printing.