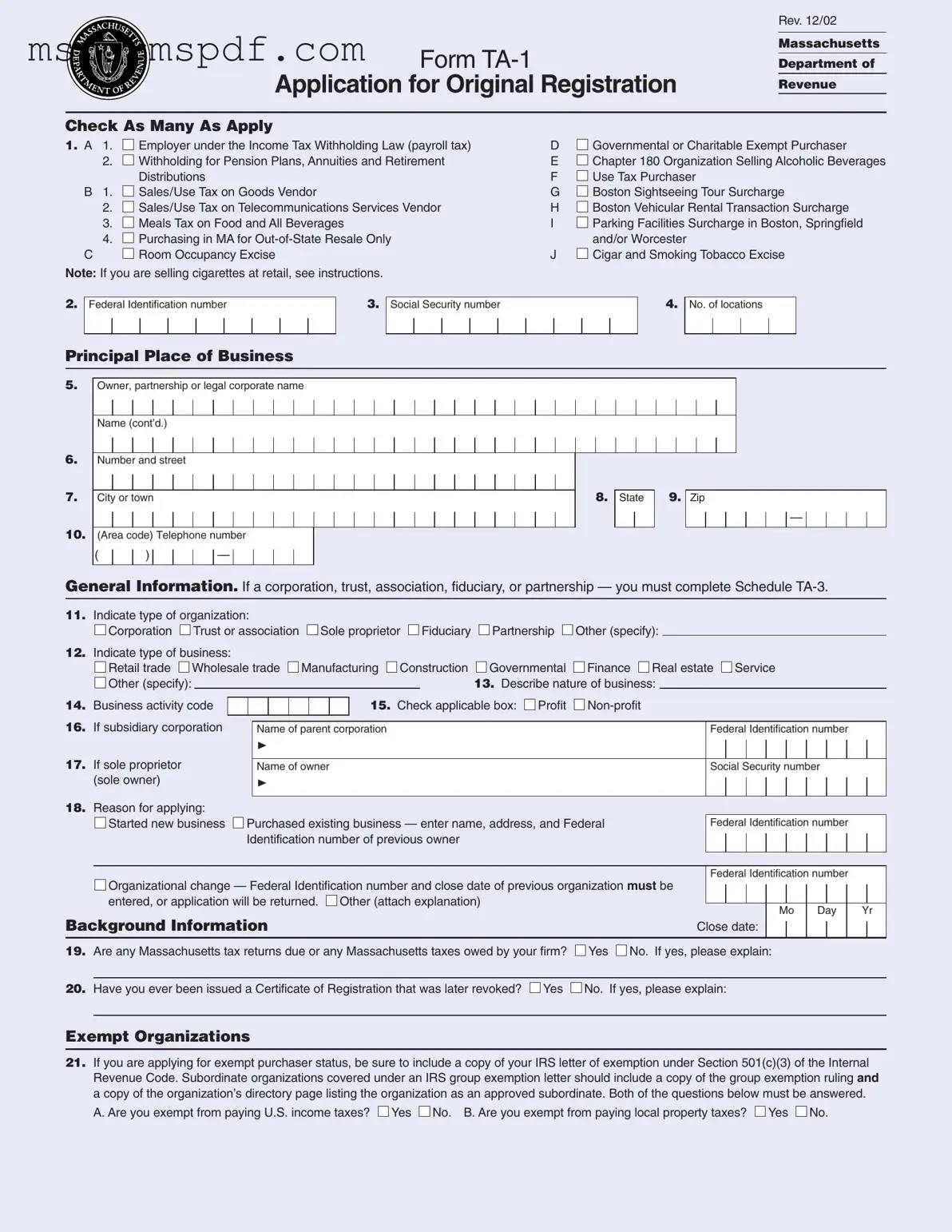

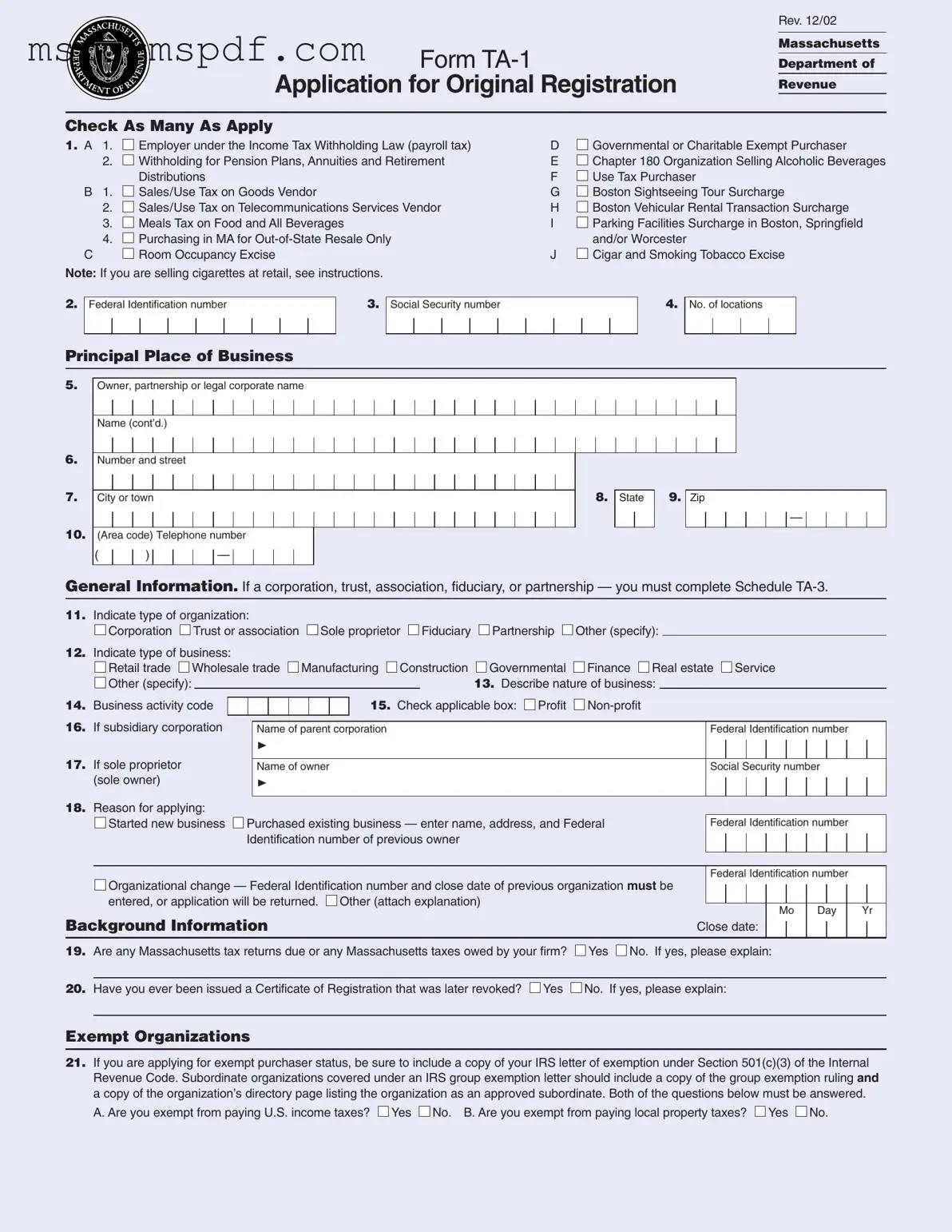

Free Massachusetts Ta 1 Template in PDF

The Massachusetts TA-1 form, officially known as the Application for Original Registration, serves as a crucial document for businesses seeking to register for various tax obligations in the state. This form enables employers, vendors, and other entities to fulfill their legal requirements under Massachusetts tax laws. Completing the TA-1 is essential for ensuring compliance and facilitating the smooth operation of your business within the Commonwealth.

Launch Editor Now

Free Massachusetts Ta 1 Template in PDF

Launch Editor Now

Launch Editor Now

or

➤ Massachusetts Ta 1 PDF Form

Just a moment — finish the form

Fill out Massachusetts Ta 1 digitally — no scanning, no printing.