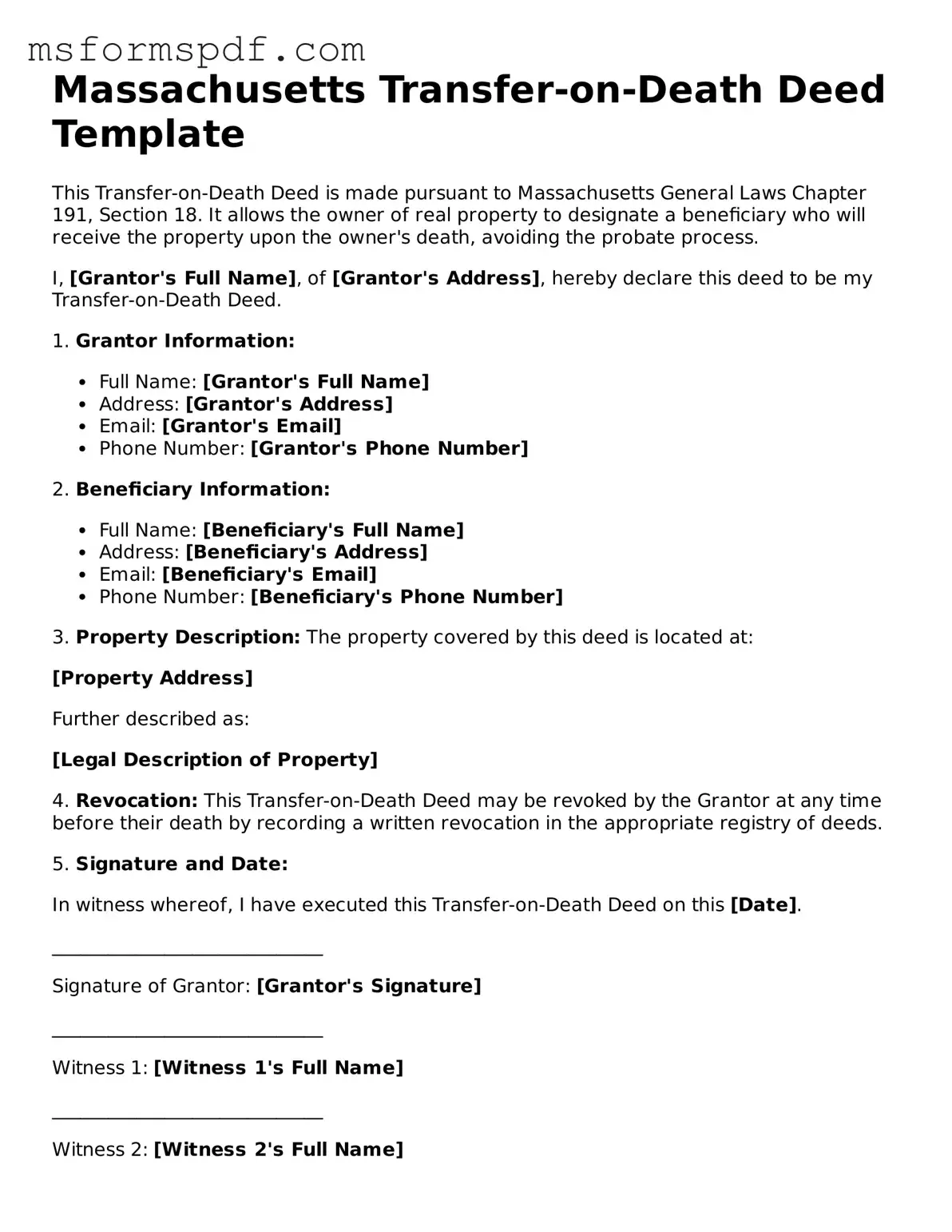

Blank Massachusetts Transfer-on-Death Deed Document

The Massachusetts Transfer-on-Death Deed form is a legal document that allows property owners to transfer their real estate to designated beneficiaries upon their death, without the need for probate. This form provides a straightforward way to ensure that your property goes directly to your loved ones, simplifying the transfer process. By using this deed, you can retain control of your property during your lifetime while planning for its future disposition.

Launch Editor Now

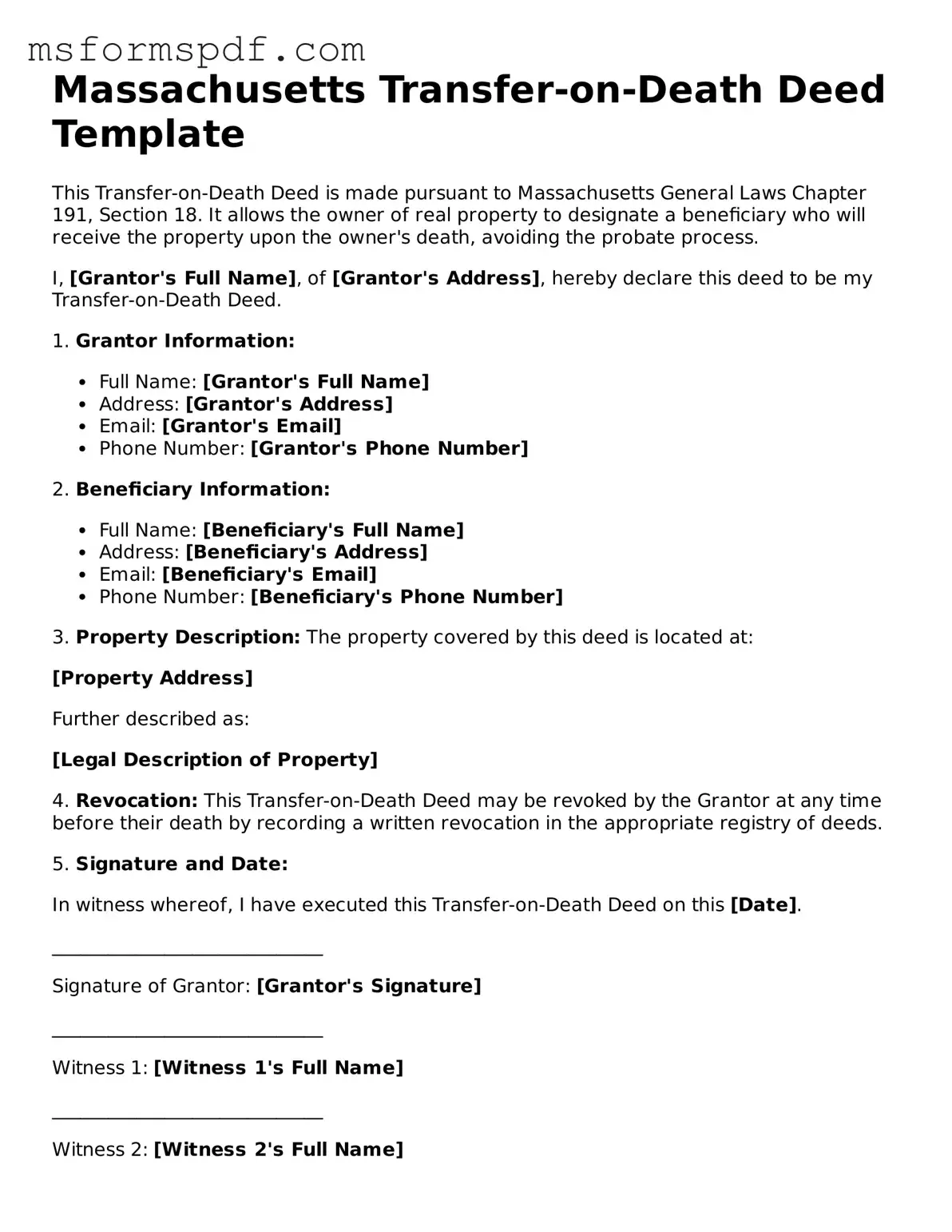

Blank Massachusetts Transfer-on-Death Deed Document

Launch Editor Now

Launch Editor Now

or

➤ Transfer-on-Death Deed PDF Form

Just a moment — finish the form

Fill out Transfer-on-Death Deed digitally — no scanning, no printing.